Dear Dr. Per Cap

I hear December per cap is going to be a lot less because of the casino closure. I count on per cap to pay bills and buy presents for my kids. What can I do to get by this holiday season?

-Worried Dad

Dear Worried Dad

We all know 2020 has been a doozy – the virus, lockdowns, recession, and a wild election. That’s why I’m excited to be working with Sequoyah Fund this fall to help guide folks through financial setbacks and uncertainties during challenging times.

The income disruption you mention is a very real concern right now. Squeezed by lost wages, lower self-employment earnings, and smaller per capita many EBCI families are living with less money than a year ago. That means less money to buy gas, less money for food, and less money for the upcoming holidays.

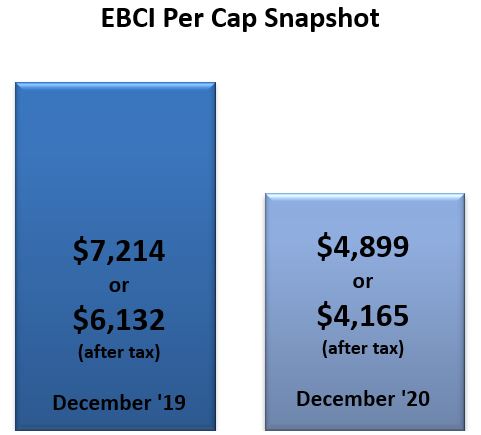

Per cap, especially, is on a lot of minds. Last month the Office of Budget & Finance announced a December per cap payment of $4,899 – down $2,315 from last December. A 32% drop is a big deal, but it could be worse. Early estimates predicted per cap could drop by 50%! Please note these numbers are before taxes are taken out. Factor in 15% federal withholding and the amount most folks will receive by check or direct deposit is $4,165.

That’s probably less than you were counting on so you’ll need to cut corners this winter. But try not to feel too bad because lots of other folks are feeling the pinch too. Heck, I haven’t ordered a pizza since the night LSU beat Clemson for the national championship. Thank you DiGiorno!

Let’s get back to basics. The quickest way to economize is to trim flexible expenses. These are costs you can control as opposed to fixed expenses, like car payments and insurance premiums, which don’t usually change on a month to month basis. You can do this by paying attention to the 3 G’s. No, I don’t mean the outdated wireless network you used to text your first emoji with a RAZR flip phone.

I’m talking gas, groceries, and gifts – three huge budget killers. Let’s start with gas. Many people are driving less these days because of the lockdowns so take advantage and cut your fuel bill as much as possible.

Groceries are a little trickier because staying home and eating more seem to go together like chips and salsa. However, if you plan menus in advance, steer clear of the packaged food aisle, and get creative with leftovers you’ll be amazed at how much you can save.

Now comes the hardest part – holiday shopping. I know, it’s been a tough year and you want to make it up to the kiddos. But please don’t break the bank on piles of presents under the tree this year. This might sound like a quote from a cheesy Hallmark card but I truly believe the greatest gift we can give to our families is love and attention.

One of my happiest Christmas memories was during my early twenties when I was really struggling to stay afloat financially. I spent Christmas Eve with my older sister and a good friend in a rundown but warm little apartment watching movies on an old VCR. No money for gifts but we scraped together enough to cook a good breakfast Christmas morning and appreciated what we did have, instead of what we didn’t. Back to basics.

Ask Dr. Per Cap – EBCI Money Smart is brought to you by Sequoyah Fund and Shawn Spruce Consulting. For more information, visit www.sequoyahfund.org. To send a question to Dr. Per Cap, email agoyopi@gmail.com.